Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

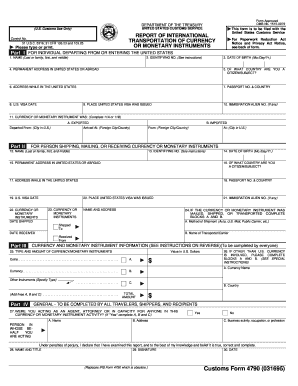

Form 4790 is a document used by the Department of Defense (DoD) to report Maintenance Action Forms (MAFs). This form is specifically used for the purpose of documenting and tracking maintenance actions performed on DoD equipment and assets. It includes information such as the type of maintenance performed, the equipment involved, the date and time of the action, any parts used or replaced, and the personnel involved in the maintenance process. The form helps ensure proper documentation and accountability for maintenance activities within the DoD.

Who is required to file form 4790?

Form 4790 is used by federal agencies, contractors, and other organizations to report accidents, incidents, and occupational injuries that occur in the workplace. It is not typically filed by individuals.

How to fill out form 4790?

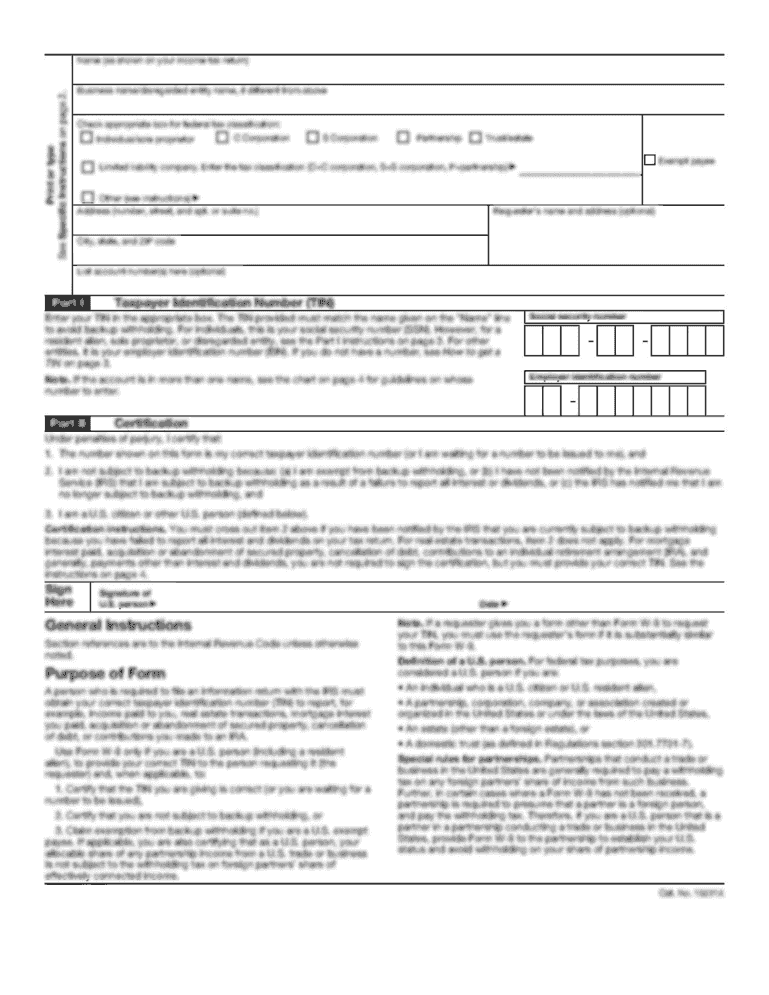

Form 4790 is a document that is used to request and obtain copies of tax returns or tax return information from the Internal Revenue Service (IRS). Here are the steps to fill out the form:

1. Begin by downloading a copy of Form 4790 from the official IRS website or obtain a physical copy from an IRS office.

2. Provide your personal information in Section 1. This includes your name, address, Social Security number (or employer identification number), and contact information.

3. Indicate the tax return(s) you are requesting in Section 2. Specify the years or period for which you want copies of tax returns or tax return information.

4. In Section 3, state the purpose for which you need the requested information. Be specific about why you require the tax return copies and how they will be used.

5. Attach any necessary supporting documents in Section 4. These may include a written explanation of your need for the information, copies of contracts, court orders, or any other relevant documentation that supports your request.

6. In Section 5, indicate whether you authorize the IRS to disclose the requested tax return information to a third party or designate any representative who should receive the copies on your behalf.

7. Sign and date the form in Section 6. If you are filing on behalf of a corporation, partnership, or other entity, include the position or title of the person signing the form.

8. Make a copy of the completed form for your records.

9. Mail the original form to the IRS office specified in the instructions for Form 4790. Ensure you include any additional documents and follow any mailing instructions provided.

Note: Be aware that there may be fees associated with obtaining copies of tax returns or tax return information. These fees should be included with the request or paid separately as instructed by the IRS.

What is the purpose of form 4790?

Form 4790 is used for reporting the sale of business property by an individual or corporation. The purpose of this form is to calculate and report any gain or loss from the sale of the property, which is then used to determine the taxable income. It helps the taxpayer to ensure compliance with the Internal Revenue Service (IRS) regulations related to the reporting of sales and gains or losses on the sale of business property.

What information must be reported on form 4790?

Form 4790, also known as the Payment Voucher, is used to report information related to payments made to vendors or contractors. The specific information that must be reported on this form includes:

1. Date of Payment: The date on which the payment was made.

2. Payment Amount: The total amount of payment made to the vendor or contractor.

3. Payee Information: The name, address, and taxpayer identification number (TIN) of the person or organization receiving the payment.

4. Deductions: Any deductions or adjustments made to the payment, such as taxes or previous payments.

5. Description of Goods or Services: A brief description of the goods or services for which the payment was made.

6. Agency Information: The name and address of the government agency making the payment.

7. Contract Information: Relevant contract or agreement details, such as contract number or reference.

8. Certification: Signature and date of the authorized official certifying the accuracy of the information provided.

The form may also include additional fields for specific information depending on the requirements of the issuing agency or organization.

What is the penalty for the late filing of form 4790?

Form 4790 is used to report a taxpayer's liability for the federal excise tax on certain types of firearms and ammunition. The penalty for late filing of this form may vary depending on the specific circumstances and the taxpayer's compliance history. However, generally, the penalty for the late filing of federal excise tax forms is 5% of the unpaid tax amount per month (or part of a month) that the return is late, up to a maximum of 25% of the unpaid tax. Additionally, interest may be charged on any unpaid tax amount from the due date of the return until it is paid in full. It's important to consult the IRS guidelines or seek professional advice for accurate and up-to-date information regarding penalties and filing requirements.

Where do I find form 4790?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the irs form 4790 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit form 4790 irs on an Android device?

With the pdfFiller Android app, you can edit, sign, and share transportation currency on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete international currency monetary on an Android device?

Use the pdfFiller mobile app and complete your form report international and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.